Buying a car is a big decision — and at Planet Motors, we believe the more you know, the easier it is to feel confident behind the wheel. That’s why we created our Resource Center, a place where you’ll find straightforward guides, expert tips, and answers to the most common questions about car buying, financing, and ownership in South Florida.

How Much Down Payment Do You Need For A Car?And How it Affects Approval

A buyer-focused explanation of what a down payment actually does, how it impacts approval strength and monthly payments, and smart ways to use cash or trade equity to structure a better deal.

Read More |

How to Trade In a Car That Is Not Paid OffFlorida Buyer's Guide

A clear, step-by-step guide to trading in a financed vehicle, including payoff logistics, positive vs. negative equity, what to bring, and how to avoid surprise balance roll-ins.

Read More |

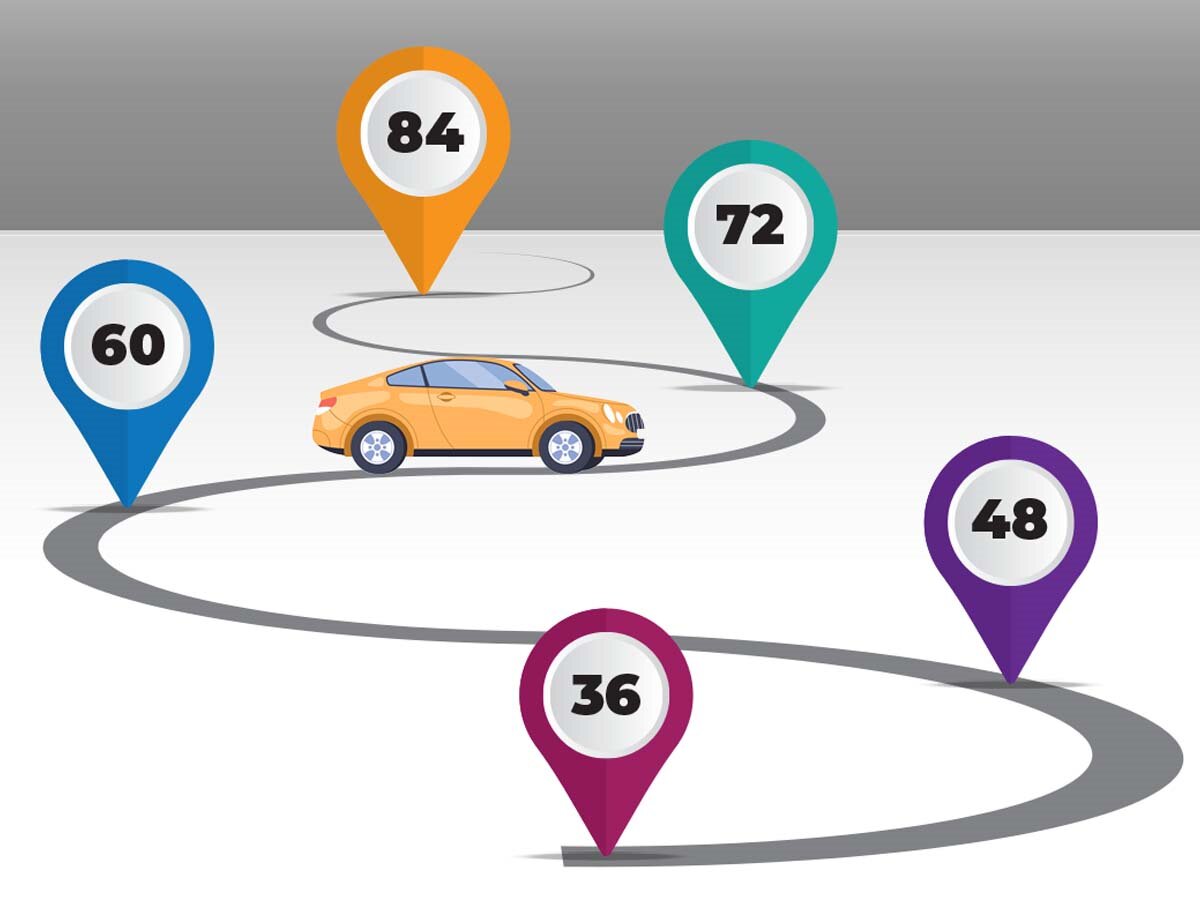

How Long Can You Finance a Car?Maximum Auto Loan Terms Explained

A practical breakdown of common loan terms (36–84 months), what determines your maximum term, and how term length changes approval strength, total cost, and negative-equity risk.

Read More |

Why Used Toyotas Keep WinningHistory, Reliability & Head-to-Head Comparisons

Toyota’s reputation wasn’t an accident. We trace the brand’s history, compare used Toyotas with Honda, Nissan, Ford, and Chevy on reliability and cost, and explain why they hold value. Finish strong with Planet Motors’ financing, trade-ins, and warranties.

Read More |

Florida’s Used Truck Market ExplainedHow Palm Beach Drivers Can Get More for Their Money

Ready to find your next truck in Palm Beach County? Learn how to spot a solid deal, avoid common mistakes, and make the most of local financing options. Planet Motors’ Florida truck guide helps you shop smarter and hit the road with confidence.

Read More |

Car Loan Documents & StipsWhat to Bring to the Dealership

Before you visit the dealership, make sure you have everything lenders need. This guide explains every stipulation (stip) — from pay stubs and proof of income to residence verification, down payment, and insurance documents — so your car loan approval goes smoothly.

Read More |

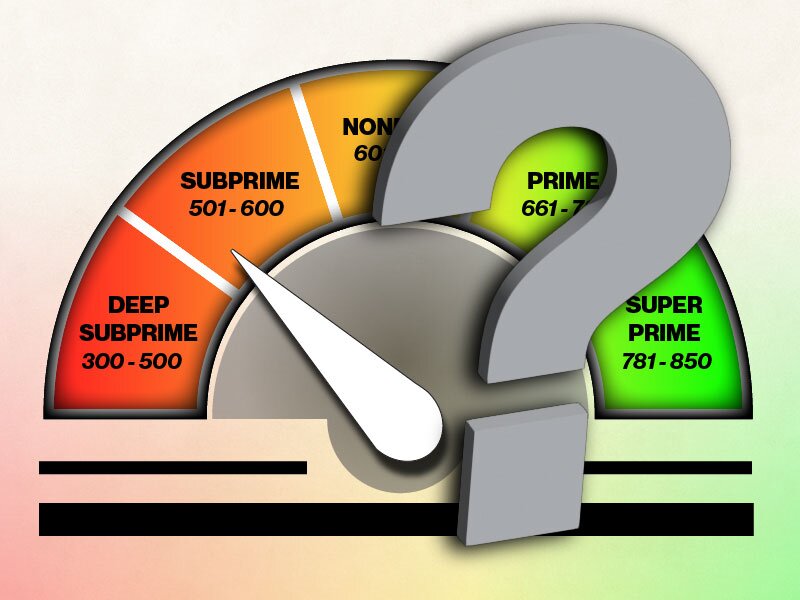

What Credit Score Do You Need to Buy a Car?A Complete Guide for Florida Buyers

Not sure what credit score you need to buy a car? Learn how lenders make decisions, what options exist for bad credit, and how buyers in West Palm Beach can still get approved.

Read More |

Buying New vs Used:How to Save Thousands Without Sacrificing Quality

Looking for your next ride? Discover why more Florida drivers are choosing used cars over new — from avoiding steep depreciation to lowering insurance costs. Learn how Planet Motors helps shoppers in Lake Worth, West Palm Beach, Boynton Beach, and beyond find affordable, reliable vehicles with financing options to fit any budget.

Read More |

How to Get Approved for a Car Loan With Bad CreditPerfect Credit Is Optional. Reliable Transportation Isn’t.

Learn how to get approved for a car loan with bad or no credit. Explore subprime, second chance, and credit union financing options with Planet Motors.

Read More |